25 NOV 2024

Understanding the Theory of Change (ToC)

In impact investing, a Theory of Change (ToC) isn’t just a framework—it’s a roadmap, and a shared vision of how we bring about meaningful change. At its core, a ToC seeks to outline the intricate steps, outcomes, and ultimate impacts an organization aspires to achieve. For iGravity, the ToC is the lens through which we connect purpose with action, ensuring that each initiative, each investment, and each partnership advances a sustainable future.

A well-designed ToC clarifies intentions and establishes the pathways by which specific actions lead to transformative results. By offering this clarity, the ToC strengthens how we strategize, adapt, and align our mission with the outcomes that ultimately shape lives and communities.

Why Theory of Change Matters for iGravity

At iGravity, the importance of a ToC goes beyond just a blueprint; it’s foundational to our philosophy and reflects our commitment to impact. With the expanding scope of our work, our ToC not only guides us internally but also allows us to communicate our mission with clarity to clients, partners, and stakeholders. By defining the steps from input to impact, our ToC unifies our diverse activities, from advisory to direct investments, showing how each action converges to drive both social and environmental change.

Why the Update?

As iGravity grows, so do our ambitions and responsibilities. This expansion brought a natural turning point—a moment to reflect, recalibrate, and refine our ToC to mirror our enhanced objectives and evolving ecosystem. The revised ToC was crafted with input from every part of our team, ensuring it embodies our core values while aligning with our vision of catalyzing systemic change through finance.

Our Updated Theory of Change: From Inputs to Impact

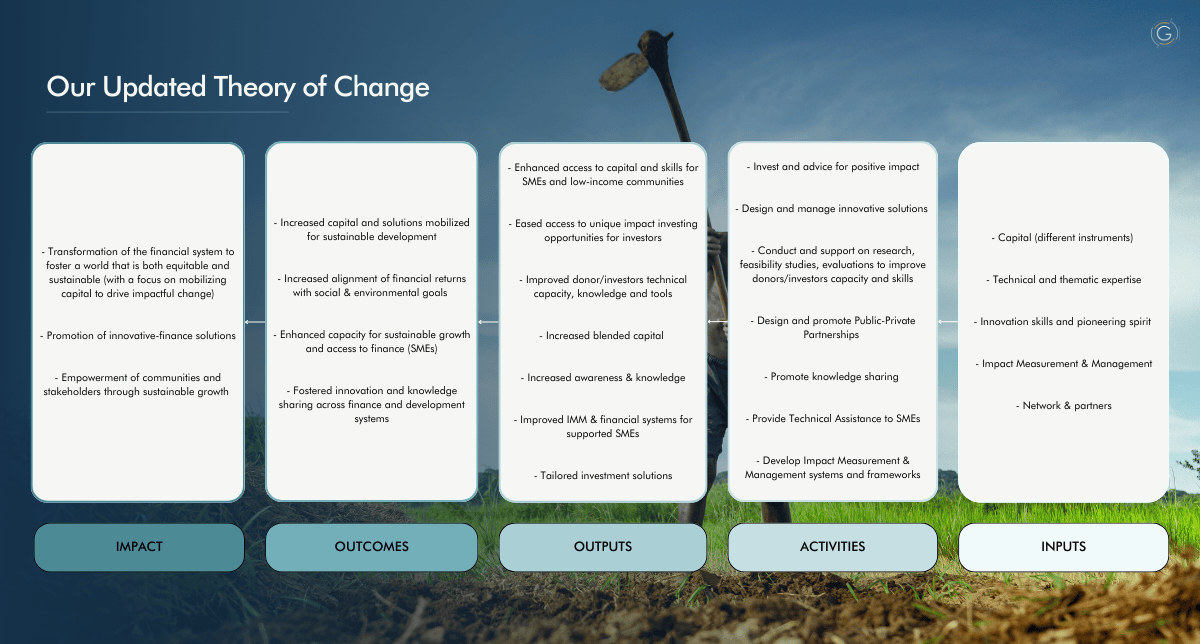

Our refreshed ToC reflects a nuanced understanding of how finance can shape the future. It begins with Inputs—capital, expertise, innovation skills, and impact measurement. These inputs fuel our Activities: providing investment advisory, consulting, implementation services, direct investments, and strategic communication. From these, Outputs are generated, such as expanded financial solutions, enhanced capacity for sustainable growth, and increased awareness around impact investing.

The journey moves to Outcomes: increased alignment of financial returns with social and environmental goals, enhanced capacity for growth, and deeper collaboration across the finance and development sectors. At the Impact level, our ultimate goal is to help shift the financial system toward one that champions a resilient, inclusive, and sustainable global economy.

Applying the ToC in Practice

An example of our ToC in action is our work with blended finance structures. By blending public, private, and philanthropic capital, we create opportunities to mobilize funds for high-impact ventures that might otherwise be overlooked. This approach enables us to drive systemic change by ensuring resources reach the areas and sectors where they’re most needed.

Looking Ahead

Our new ToC is more than a framework; it’s a commitment to fostering an equitable world. As we engage with partners and clients, we’ll rely on this roadmap to enhance transparency, guide impactful investments, and create measurable change. Each step is a testament to our belief in finance as a force for good, driving us toward a world where economic opportunity aligns with sustainable, lasting progress.